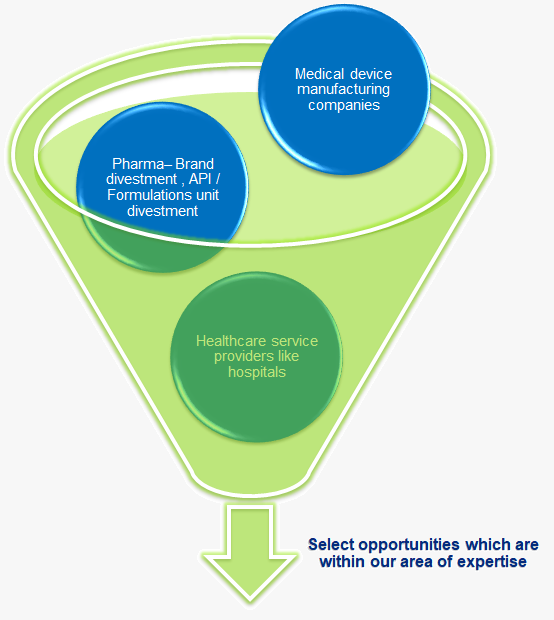

Our Investment banking business primarily deals in M&A advisory and Fund raising. We focus on sub-corporate deals for M&A transactions like sale/ purchase of brands, business units, manufacturing facilities etc.

At our Fund raising business, we primarily focus on raising capital in excesss of US$ 2 Million.

We have developed a robust methodology to take our client through the process of deal making.

We have successfully assisted our clients in domestic and cross-border transactions. Our clients have engaged us for both buy-side and sell-side advisory. We advise for the entire business or for strategic acquisition / divestiture of part of a business or of a particular brand portfolio in case of pharmaceutical companies.

Evaluation of the opportunity ( business / brand / asset ) to identify its USP & appropriate positioning

Screening of market for evaluating and identifying suitable prospect(s) for acquiring the client business

Our main strength is structuring of transactions to ensure a win-win scenario for both the parties

We assist start-ups and mature companies to raise capital preferably in excess of US$ 2 Million. Our service spans across the entire transaction cycle such as business evaluation, business case preparation (pitch deck & financial modelling), investor search, term sheet & transaction structuring, co-ordination for due diligence, negotiations, closure & post - closure activities.

Business model & technology / innovation evaluation across different sectors such as healthcare delivery, diagnostics, medical technology etc

Assessment of capital required, revenue projection & expected returns scalability, competitive moat and positioning strategy for the start-up

Screening suitable healthcare start-up financiers & reaching out to them

Engaging with the prospective investor(s) & working towards a successful closure

This is one of our boutique offerings where we partner with innovative healthcare companies and help them to commercialize and scale-up their product / technology. One of the major challenges for start-ups is to gain initial traction for their product / technology. Our extensive network in the healthcare industry equips us to identify the right commercial partner for your innovation and structure the appropriate licensing or alliance or Joint Venture agreement to realize maximum value for your innovation.

We create value by collaborating with the Innovator companies and representing them to commercialize their innovation.

Identify: Identifying innovative and path breaking technologies first to the Indian/ Asian market

Evaluate: Assess techno-commercial feasibility to determine the market potential of the innovation

Collaborate

Commercialize – Licensing / Distribution

Commercialization achieved using -

Finalize the partnership model and provide the following support to execute the partnership